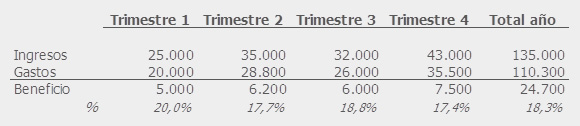

The benefit can be considered in two ways:

- As an absolute value ("This month I won X ...")

- As a relative value ("My benefit is a% of my income")

The benefit as a figure tells us what we earn in a specific amount, on which we will pay taxes. Variations in this figure at the end of each quarter will only tell us if we earn more or less money. On the other hand, the percentage on income gives us more information.

Comparing this percentage over the months, we will know if we are more efficient in our management of the clinic, regardless of the turnover.

An example will help explain it ...

In this case, the quarter in which the most benefits are obtained is the 4th, but instead it is not only the one with the lowest percentage of benefits over income, but also, this percentage is below the annual average. This would have to make us jump the alarms because it is also the quarter in which more has been invoiced.

It is clear that Quarter 1 has been the most efficient of all, because, although it is true that the profit figure has been the least in absolute value (€ 7,500), it is the month in which the benefit has been greater compared to the volume of revenues (17.4%).

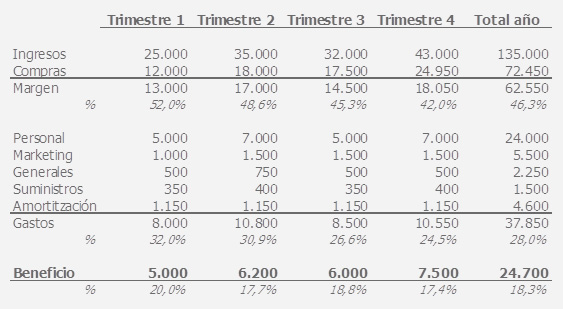

What happened in Quarter 4? What has gone wrong?

The answer can only come from a more careful analysis of the figures. Although at the moment we will consider the income at the global level, the same does not happen with the expenses, which can be grouped into different categories. Each group depends on the cost structure of each clinic, but at a general level, an income statement could be defined as follows:

Purchases

It groups the purchases of material that we use directly in our work at the dental clinic: consumables, implants, prostheses, etc. It is recorded when the invoice is purchased, and not when it is paid.

Margin

The first difference between our income and the purchase invoices is the margin. It tells us what percentage we charge to our purchase. In this case, the price revolves around 50% of the margin. In Quarter 4, we can think that:

- Either we have bought a lot of material that we have not used yet (in this case it is a temporary issue),

- Either we have bought the same and we have had to make cheaper treatments due to the downward pressure of the market (in this case we should try to improve the margin, either by raising prices or by buying cheaper).

Expenses

The margin should allow us to absorb the expenses of the cynic. They should be those that allow the clinic to function, such as general staff costs or supplies. And others not so essential but that we assume to have more presence in the market, such as those intended for marketing campaigns. The amortization corresponds to the wear and tear due to the use of the equipment purchased and the facilities of the clinic.

The final benefit

It is what we have left after having faced all the expenses. Taxes will be paid on this amount. As can be seen, the starting point (income) and the end point (benefits) are the same, but the importance is in the information it provides. A good accounting and a good analysis of the finances allow to know the evolution of the business and to take corrective actions.